👩🌾Yield Farms

SpiritSwap itself is simply a blockchain protocol which by design, does not offer any resources for utilization. As such, in order to provide users easy access to $SPIRIT and for the protocol to perform its core function as a DEX, users would need to be incentivized to play the role of liquidity providers and stake their digital asset pairs (e.g. FTM/SPIRIT) into the decentralized market making pools to provide the necessary liquidity for transactions. As compensation for opportunity costs, these liquidity providers which help to promote adoption of SpiritSwap by staking or including assets to selected liquidity pools (i.e. gauges) in exchange for SPIRIT-LP tokens would be rewarded with $SPIRIT (i.e. "farming" on SpiritSwap), according to each user's relative contribution after various adjustment and correction parameters.

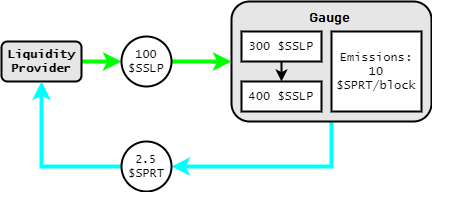

In Figure 1 example of a liquidity provider depositing supported SPIRIT-LP tokens to the gauge contract.

In the aforementioned example, the gauge contract emits 10 $SPIRIT/block and the new farmer owns 100 out of 400 SPIRIT-LP tokens in the farming contract. Therefore, the liquidity provider will be earning 2.5 $SPIRIT tokens per block.

In the manner of true decentralization, the SpiritSwap farms operate on a "gauge model". This offers inSPIRIT holders the opportunity to decide where weekly farming emissions are delegated from the beginning to end of each epoch.